Are you tired of skyrocketing rent prices? Sick of throwing money away each month with nothing to show for it? What if there was a housing option that could cut your monthly payments by 30% or more while giving you a say in how your building is run? Welcome to the world of housing cooperatives, America’s best-kept secret for affordable living!

What Is a Housing Co-op (And Why Should You Care?)

A housing cooperative (or co-op for short) is a form of shared homeownership where residents don’t technically own their individual units. Instead, they own shares in a corporation that owns the entire building or community. This might sound complicated, but the benefits are anything but:

- Lower monthly housing costs (sometimes way lower than market rate)

- No landlord hiking up your rent every year

- Community control over your living environment

- Long-term housing security you can’t get from renting

Unlike traditional apartments where a landlord makes all the decisions (and profits), co-op members democratically control their housing. Each member gets a vote in major decisions, from setting monthly fees to approving repairs or improvements.

“Housing co-ops represent one of the most sustainable affordable housing models in America,” says the National Association of Housing Cooperatives. “They provide permanent affordability while building community wealth.”

Types of Housing Co-ops: Which One Fits Your Needs?

Not all housing co-ops are created equal. Here are the main types you’ll encounter:

Market-Rate Co-ops

In these co-ops, members can buy and sell shares at whatever price the market will bear. The initial buy-in cost can be similar to purchasing a comparable condo, but monthly charges are typically lower. Market-rate co-ops are common in cities like New York and Washington DC.

Limited-Equity Co-ops

These are the true affordable housing heroes! Limited-equity co-ops restrict the resale price of shares, keeping them affordable for future buyers. Your initial investment might be as low as $2,000-$10,000, with monthly charges far below market rent. If you’re looking for truly affordable housing, this is your golden ticket.

Leasing Co-ops

These co-ops don’t own their buildings but instead lease them from an outside owner. Members still control day-to-day operations and enjoy stable housing, though without the equity-building advantages of ownership.

Senior Housing Co-ops

Designed specifically for older adults, these communities offer independent living with supportive services. They’ve become increasingly popular with baby boomers looking for community-oriented retirement options.

How to Join a Housing Co-op: Your Step-by-Step Guide

Ready to ditch your landlord and join the co-op movement? Here’s how to make it happen:

1. Find Available Co-ops in Your Area

Start by searching online directories like the National Association of Housing Cooperatives or local affordable housing agencies. You can also check out our guide on state-specific housing programs for additional resources.

2. Understand the Financial Requirements

Co-ops typically require:

- An initial share purchase (ranges from $2,000 to $100,000+ depending on type and location)

- Monthly carrying charges (covers mortgage, taxes, maintenance, and utilities)

- Proof of income stability (typically 2-3 times the monthly charges)

If you’re struggling financially, don’t give up! Many co-ops participate in subsidy programs similar to the Section 8 Rental Assistance Program to help lower-income households join.

3. Complete the Application Process

Most co-ops have an application process that includes:

- Financial documentation

- Personal references

- An interview with the membership committee

Don’t be intimidated! The interview is simply to ensure you understand the cooperative principles and are willing to participate in the community.

4. Get Approved and Move In

Once approved, you’ll purchase your shares, sign an occupancy agreement, and become a proud co-op member-owner!

Where to Find Housing Co-ops: Hidden Gems Across America

Housing co-ops exist all across America, but they’re particularly common in these hotspots:

New York City

The co-op capital of America! NYC boasts over 1,700 cooperative buildings, from luxury high-rises on Park Avenue to affordable limited-equity co-ops in the outer boroughs.

Washington, DC

The nation’s capital has embraced co-op living, with notable communities like the Sursum Corda Cooperative and the Tiber Island Cooperative Homes.

San Francisco Bay Area

With some of America’s highest housing costs, the Bay Area has developed innovative co-op models including the San Francisco Community Land Trust.

The Midwest Corridor

Cities like Chicago, Minneapolis, and Detroit have strong co-op traditions, often with more affordable entry points than coastal cities.

Rural Communities

Don’t think co-ops are just for city dwellers! Rural housing cooperatives provide affordable homeownership opportunities in smaller communities too.

The Financial Magic of Co-op Living

Let’s talk money – because that’s why most people consider co-ops in the first place.

Lower Monthly Costs

Co-ops typically cost 20-30% less than comparable rental properties. Why? Because there’s no landlord taking profit, and co-ops are often eligible for better mortgage rates and tax benefits as nonprofit corporations.

For example, in Washington DC, a two-bedroom apartment might rent for $2,500 monthly, while a similar co-op unit might have carrying charges of just $1,700.

Tax Benefits

Co-op members can deduct their portion of the building’s mortgage interest and property taxes from their personal income taxes – just like homeowners!

Protection from Market Fluctuations

Unlike renters who face unpredictable increases, co-op monthly charges only rise when necessary for actual building expenses.

Building Equity

While you won’t get rich quick, most co-ops allow members to build some equity over time. Even limited-equity co-ops typically allow your initial investment to grow by a modest, predetermined amount each year.

The Hidden Benefits Nobody Talks About

Beyond the financial advantages, co-ops offer social benefits that are harder to quantify but equally valuable:

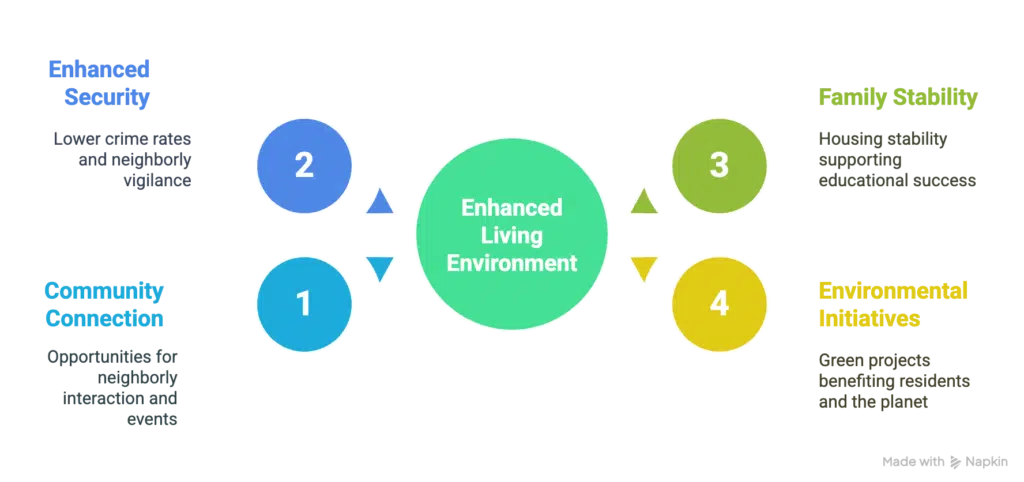

Community Connection

In today’s isolated world, co-ops provide natural opportunities for neighborly interaction. Many co-ops host community events, shared meals, and collaborative projects.

Enhanced Security

When neighbors know each other, they look out for one another. Co-ops typically have lower crime rates and better security than comparable rental buildings.

Stability for Families

For families with children, co-ops provide housing stability that supports educational success. No more school changes due to landlord whims or rent hikes!

Environmental Benefits

Many co-ops implement green initiatives like solar panels, community gardens, and energy-efficient upgrades that benefit both the planet and residents’ wallets.

Challenges to Consider:

While co-ops offer amazing benefits, they’re not perfect for everyone. Here are some honest considerations:

Approval Process

Getting approved for a co-op can be more involved than renting. If you need immediate housing or have credit challenges, check out our guide on how to find rent-free sober living for temporary options.

Participation Requirements

Most co-ops expect members to participate in governance, serve on committees, or contribute sweat equity. If you’re not interested in community involvement, co-ops might not be your best fit.

Financing Challenges

Some banks are less familiar with co-op financing, though this is changing. Government-backed loans through the Department of Housing and Urban Development can often help.

Rules and Restrictions

Co-ops typically have more rules than rental buildings – from approval processes for renovations to policies about subletting. These protect the community but may feel restrictive to some.

Is a Housing Co-op Right for You?

Co-ops are fantastic for people who:

- Value community and democratic control

- Plan to stay in one place for at least 3-5 years

- Are willing to participate in governance

- Want stable, predictable housing costs

- Seek affordability without sacrificing quality

If you’re struggling with current housing costs, co-ops offer a sustainable alternative to traditional rentals. And unlike temporary solutions like the $5,000 stimulus check, co-ops provide lasting affordability.

How to Start Your Own Housing Co-op

Can’t find an existing co-op in your area? Consider starting one! While challenging, creating a new co-op is entirely possible with the right resources:

- Gather interested households (typically 5-20 families)

- Form a steering committee to research options

- Incorporate as a nonprofit cooperative corporation

- Identify potential properties to purchase

- Secure financing through cooperative-friendly lenders

- Develop governance documents like bylaws and occupancy agreements

Resources like the National Cooperative Law Center and local community development organizations can provide guidance throughout this process.

Ready to Start?

Housing co-ops represent one of America’s best solutions for affordable, community-controlled housing. While they require more initial effort than simply signing a lease, the long-term benefits – financial, social, and emotional – make that effort worthwhile.

Whether you’re a young professional tired of roommates, a family seeking stability, or a retiree on a fixed income, there’s likely a co-op model that fits your needs and budget.

Ready to explore co-op living? Start by contacting your local housing authority or visiting the National Association of Housing Cooperatives to find options in your area.

Your journey to affordable, democratic housing begins now!