Getting affordable housing starts with one crucial step: completing your PHA pre-application correctly. This initial form is your gateway to affordable housing programs, and many applicants unknowingly make mistakes that can delay their housing for months or even years.

The pre-application process might seem straightforward, but there’s more strategy involved than most people realize. Success depends heavily on understanding property types, knowing which programs you qualify for, and avoiding common pitfalls that trip up thousands of applicants every year.

Understanding the Pre-Application Process

Your pre-application serves as the foundation for your entire affordable housing journey. Housing authorities use this information to determine your eligibility, place you on appropriate waiting lists, and eventually match you with suitable housing options.

Unlike your final Section 8 Housing Choice Voucher application, the pre-application focuses on gathering initial information about your household composition, income levels, and housing preferences. This data helps housing authorities understand your needs and prioritize your placement on various waiting lists.

The key difference between a pre-application and a full application is timing and detail. Pre-applications typically require less documentation but demand strategic thinking about which properties and programs align with your needs and qualifications.

Strategic Property Selection: Your Path to Success

The most critical aspect of your pre-application is choosing the right properties. This decision directly impacts how quickly you’ll receive housing and whether that housing meets your family’s needs.

Housing authorities typically offer several property types:

Tax Credit Properties provide income-restricted housing with reduced rent payments. These properties often have longer waiting lists but offer significant savings for qualifying families. Before selecting these options, review the current 2025 income limits to ensure you qualify.

HUD-Assisted Properties receive federal subsidies that help cover rent costs. These units often have shorter waiting lists in certain areas but may have specific location constraints.

Public Housing Units are owned and operated directly by housing authorities. While these provide stable, long-term housing options, availability varies significantly by region.

Mixed-Income Properties combine affordable units with market-rate housing, often providing better neighborhood amenities and less housing concentration.

When selecting properties, consider these factors:

- Location accessibility to employment, schools, healthcare, and public transportation

- Unit size that accommodates your current household and potential changes

- Waiting list length and movement patterns for each property

- Neighborhood characteristics that align with your family’s needs

- Accessibility features if anyone in your household has mobility requirements

Essential Documentation and Preparation

Successful pre-applications require thorough preparation. Gather these documents before starting your application:

Household Information: Complete names, birthdates, Social Security numbers, and relationship details for all household members. Include anyone who will live in the unit, including children who spend significant time with you.

Income Documentation: Recent pay stubs, Social Security statements, disability benefits, unemployment compensation, and any other income sources. If you receive Social Security payments, understanding how these factor into income calculations is crucial for accurate reporting.

Identification: Government-issued photo identification for all adult household members, birth certificates for children, and immigration documents if applicable.

Special Circumstances: Medical documentation for disabilities, court orders for custody arrangements, and verification of student status if applicable.

Contact Information: Current phone numbers, email addresses, and mailing addresses. Include backup contact information for someone who can reach you if your primary contact changes.

Avoiding Critical Mistakes

Many applicants sabotage their chances without realizing it. Here are the most common errors and how to avoid them:

Inadequate Property Research: Randomly selecting properties without understanding their requirements, location benefits, or waiting list status wastes time and opportunities. Research each property thoroughly, including neighborhood characteristics, transportation access, and unit availability patterns.

Incomplete Applications: Missing information delays processing and may result in application rejection. Double-check every section before submission, ensuring all required fields are completed accurately.

Outdated Contact Information: Housing authorities remove applicants from waiting lists when they can’t establish contact. Update your information immediately when phone numbers, addresses, or email addresses change.

Mismatched Property Selection: Applying for properties that don’t align with your household size, income level, or accessibility needs creates unnecessary delays. If you’re unsure about income limits or program requirements, consult resources about state-specific housing programs to understand your options.

Last-Minute Documentation Gathering: Rushing to collect required documents leads to errors and missed deadlines. Start gathering paperwork well before application deadlines to ensure accuracy and completeness.

Failure to Understand Program Requirements: Different housing programs have varying eligibility criteria, income limits, and application processes. If Section 8 isn’t available in your area, explore state-specific housing programs that might offer alternative pathways to affordable housing.

Insurance Requirements and Preparation

Most affordable housing properties require renters insurance before move-in. This coverage protects both you and the property owner from potential damages and liability issues.

Renters insurance typically costs between $10-30 monthly and provides coverage for personal belongings, liability protection, and additional living expenses if your unit becomes uninhabitable. Securing this coverage early demonstrates responsibility to housing authorities and landlords.

When shopping for renters insurance, compare coverage limits, deductibles, and additional protections. Some policies include identity theft protection, pet liability coverage, and temporary housing assistance.

Maximizing Your Application Success

Beyond avoiding common mistakes, several strategies can improve your application outcomes:

Apply Early and Often: Submit applications as soon as waiting lists open. Many housing authorities use lottery systems or first-come, first-served processes that favor early applicants.

Diversify Your Applications: Apply for multiple property types and locations to increase your chances of receiving housing offers. Don’t limit yourself to just one type of affordable housing.

Stay Organized: Maintain copies of all application materials, correspondence with housing authorities, and important dates. Create a system for tracking multiple applications and their requirements.

Maintain Flexibility: Be open to different neighborhoods, unit sizes, and property types. Rigid preferences often lead to longer waiting times and missed opportunities.

Understand Preference Categories: Many housing authorities give priority to certain applicant groups, such as veterans, elderly individuals, or families with disabilities. Understand which preferences apply to your situation.

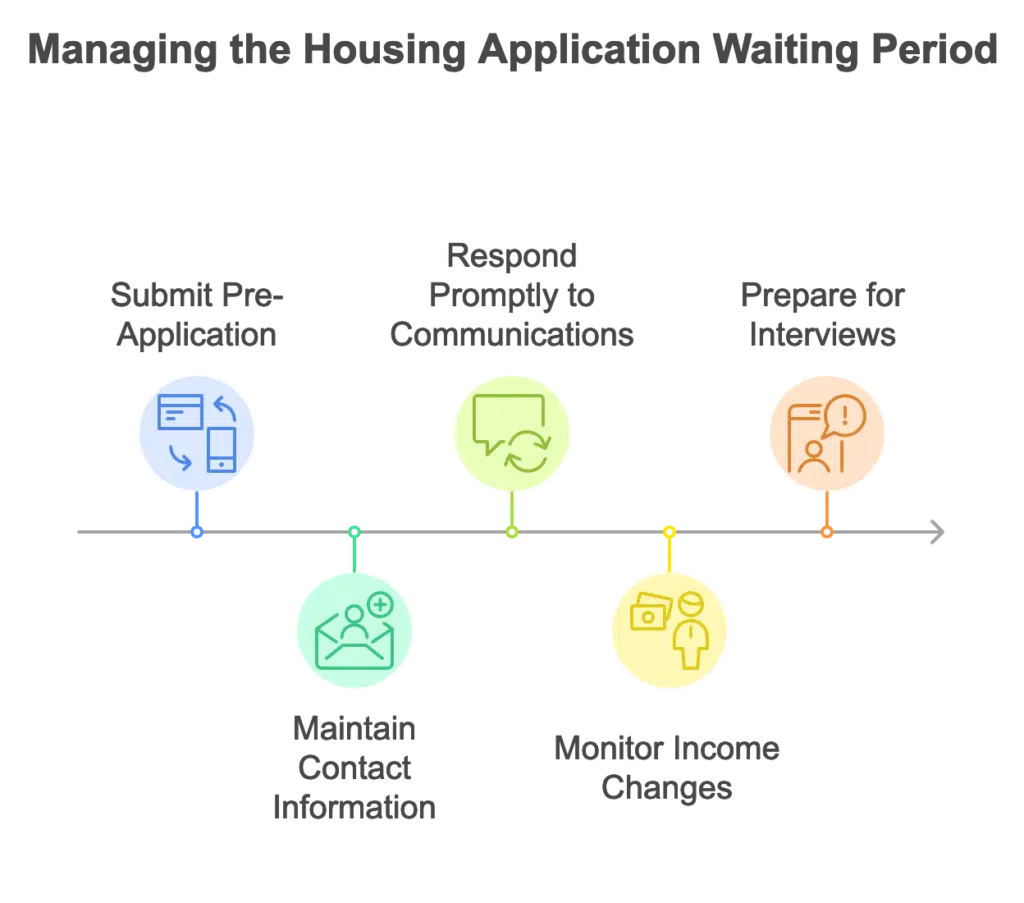

Once you submit your pre-application, the waiting period begins. This time varies dramatically based on location, property type, and local housing demand.

During this period:

Maintain Current Contact Information: Notify housing authorities immediately of any address, phone, or email changes. Set up mail forwarding if you move during the waiting period.

Respond Promptly to Communications: Housing authorities often have strict deadlines for responding to requests for updated information or housing offers. Missing these deadlines can result in removal from waiting lists.

Monitor Income Changes: Report significant income increases or decreases that might affect your eligibility. Failing to report changes can lead to application rejection or program violations.

Prepare for Interviews: Some housing authorities conduct interviews during the application process. Prepare by reviewing your application materials and gathering any additional documentation they might request.

Leveraging Available Resources

Take advantage of available resources to improve your application success:

Interactive Housing Guides: Comprehensive online resources like the Affordable Housing Heroes interactive guide can help you understand the entire affordable housing process, from initial applications through move-in procedures.

State-Specific Programs: Each state offers different housing assistance programs beyond federal options. Research these alternatives to expand your housing opportunities.

Community Organizations: Local nonprofits often provide application assistance, housing counseling, and advocacy services for affordable housing applicants.

Housing Authority Websites: Most housing authorities provide detailed information about their specific programs, waiting lists, and application requirements.

Planning for Success

Your pre-application represents the beginning of your affordable housing journey, not the end. Approach this process strategically by researching your options thoroughly, preparing complete documentation, and avoiding common pitfalls that delay approval.

Remember that affordable housing demand typically exceeds supply, making preparation and persistence essential for success. By following these guidelines, maintaining accurate records, and staying engaged throughout the process, you’ll significantly improve your chances of securing housing that meets your family’s needs.

The time invested in properly completing your pre-application pays dividends through faster processing, better housing matches, and fewer complications during the approval process. Take control of your housing future by mastering this crucial first step toward affordable housing success.