If you’re applying for affordable housing through programs like Section 8, the pre-application is your first big step. This form gives housing agencies the basic info they need about you—like your income, family size, and housing needs.

But there’s more to it than just filling out the form. One of the most important parts is choosing the right properties. Picking homes that don’t match your situation could mean waiting longer—or missing out on a home altogether.

In this guide, we’ll explain how to get your pre-application right, why picking the right properties is so important, and how to avoid common mistakes. Whether you’re applying for Section 8 or other low-income housing programs, these tips will help.

What Is a Pre-Application for Section 8?

The pre-application is the first step to getting on a Section 8 or affordable housing waiting list. It’s not the full application yet, but it helps housing agencies figure out if you qualify for assistance.

Programs like Section 8, HUD-assisted units, and tax-credit properties use pre-applications to learn about your family, income, and housing needs. If the agency decides you qualify, you’ll be added to their waiting list.

One key part of the pre-application is choosing which properties you’re interested in. Housing agencies offer different types of properties, and not all will be right for you. For example, some properties are tax-credit units, while others are federally funded through HUD or Section 8.

Confused about tax credits or how they help? Check out our guide to Tax Credits for Low-Income Housing.

Why Choosing the Right Housing Matters

Picking the right properties on your pre-application can save you a lot of time and trouble. If you choose homes that don’t match your family’s size, income, or needs, you could face long delays—or worse, end up with a place that doesn’t work for you.

Here’s why it’s so important:

- Location: Is the property close to work, school, or public transportation?

- Size: Does it have enough bedrooms for your family?

- Type of Housing: Do you qualify for that type of property, like HUD-assisted apartments or tax-credit units?

Making good choices means you’re more likely to get matched with housing that fits your life.

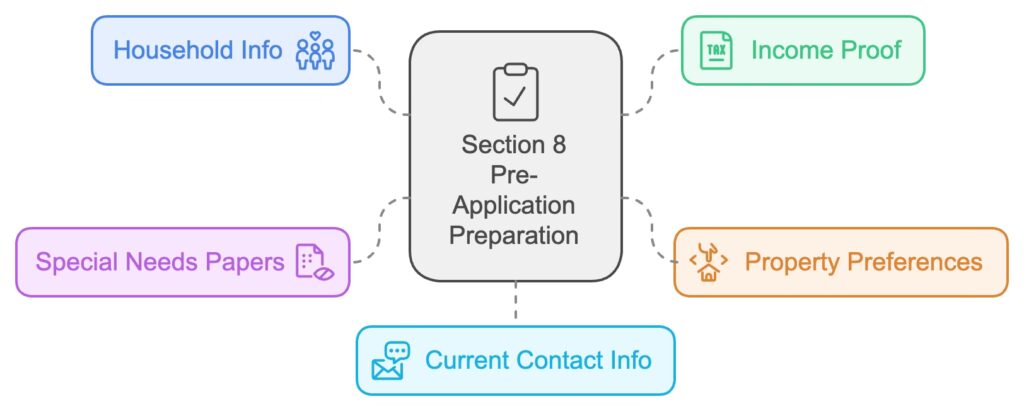

How to Prepare for Your Section 8 Pre-Application

Getting your pre-application right is easier if you’re prepared. Here’s what you need to gather before you start:

- Household Info: Names, birthdays, and relationships of everyone in your household.

- Income Proof: Pay stubs, benefit letters, or other documents that show your income.

- Property Preferences: Research the properties available in your area and make a list of the ones that work best for you.

- Special Needs Papers: If anyone in your household has a disability or is 62 or older, gather any required documentation.

- Current Contact Info: Double-check your phone number and address. If the agency can’t reach you, they might remove you from the waiting list.

Being organized will save you a lot of time and stress.

How to Choose the Right Properties for Section 8

Housing agencies offer different types of properties, and picking the right ones is key. Here are the main types you might see:

- HUD-Assisted Properties: These homes are federally funded, and your rent is based on your income.

- Tax-Credit Properties: These are also income-based, but they’re funded through tax credits and have different rules.

- Market-Rate Units: These homes don’t adjust rent based on income, but they might offer good locations or features.

When deciding, think about:

- Does the home fit your family size? Make sure the number of bedrooms matches your needs.

- Is the location convenient? Check if it’s close to work, schools, or other places you need to go.

- Does the property meet your needs? For example, is it wheelchair accessible or senior-friendly?

For more tips, check out our guide on what to do if your Section 8 application is denied.

What Happens After You Submit Your Pre-Application?

Once you submit your pre-application, you’ll be added to a waiting list. The length of your wait depends on the demand for housing and the properties you applied for.

While waiting:

- Keep Your Info Updated: If your phone number or address changes, tell the agency right away.

- Report Income Changes: If your household income changes, update your application.

- Respond Quickly: If the agency asks for more documents or information, don’t delay.

Some waiting lists move faster than others, so staying on top of things is important.

Mistakes to Avoid When Applying for Section 8

Many people make simple mistakes that slow down their application. Avoid these to make the process smoother:

- Not Researching Properties: Don’t just pick random homes. Take time to choose properties that fit your needs.

- Leaving Out Info: Missing key details like income or household size can delay or disqualify your application.

- Outdated Contact Info: If the agency can’t reach you, you could lose your spot.

- Applying for the Wrong Housing: Make sure you qualify for the properties you pick.

Avoiding these mistakes will help you move forward faster.

Does Credit Matter for Section 8 or Affordable Housing?

Yes, sometimes. Even if you qualify for Section 8, some landlords might run a credit check before approving you. A good credit score can show that you’re reliable when it comes to paying bills.

To learn how to improve your credit and increase your housing options, check out our post on how Musk and Trump’s ideas about finances could impact affordable housing.

FAQ: What You Need to Know About Pre-Applications

What is a pre-application?

It’s the first step to getting on the waiting list for Section 8 or other housing programs.

Can I apply for more than one property?

Yes. Applying for multiple properties increases your chances of getting housing.

How long will I be on the waiting list?

It depends on the property and the demand. Some lists move faster than others.

What info do I need for the pre-application?

You’ll need household details, proof of income, and documents for any special needs.

Does credit affect my application?

Sometimes. Landlords may check your credit score even if you qualify for Section 8.

The affordable housing process can take time, but being prepared makes all the difference. By filling out your pre-application carefully and choosing properties that match your needs, you’re giving yourself the best chance at finding the right home. The more prepared you are, the smoother the journey to your new home will be.